Do you have a property deal you'd like to share? Whether it's a buy-to-let, BRR, HMO, or flip, we'd love to hear about it! Submit your deal today and let us help you maximize its potential.

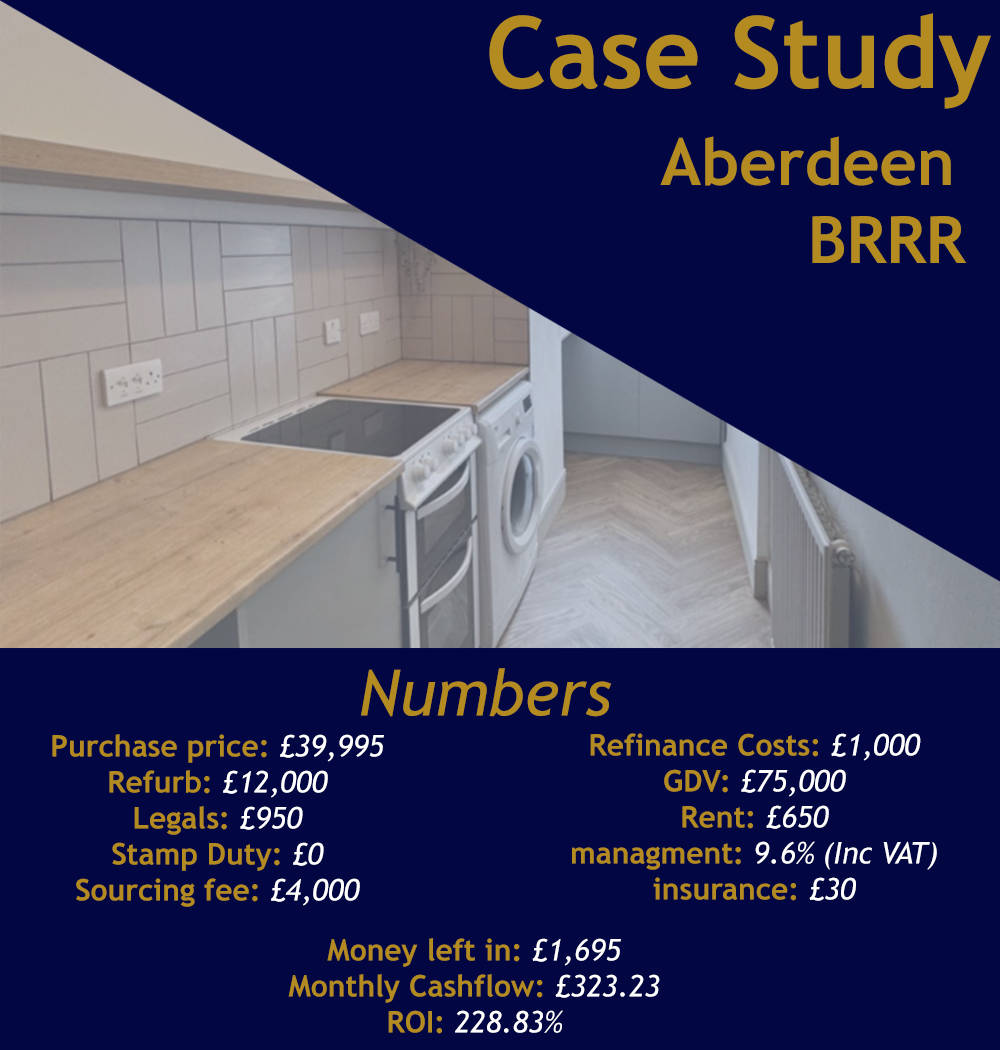

We secured this property at £39,995, and it had a current Market valuation at £65,000, making the property 38.47% BMV! after a £12,000 refurb, the property was revalued at £75,000 getting our client all his money out, he has now agreed a rental at £650pcm

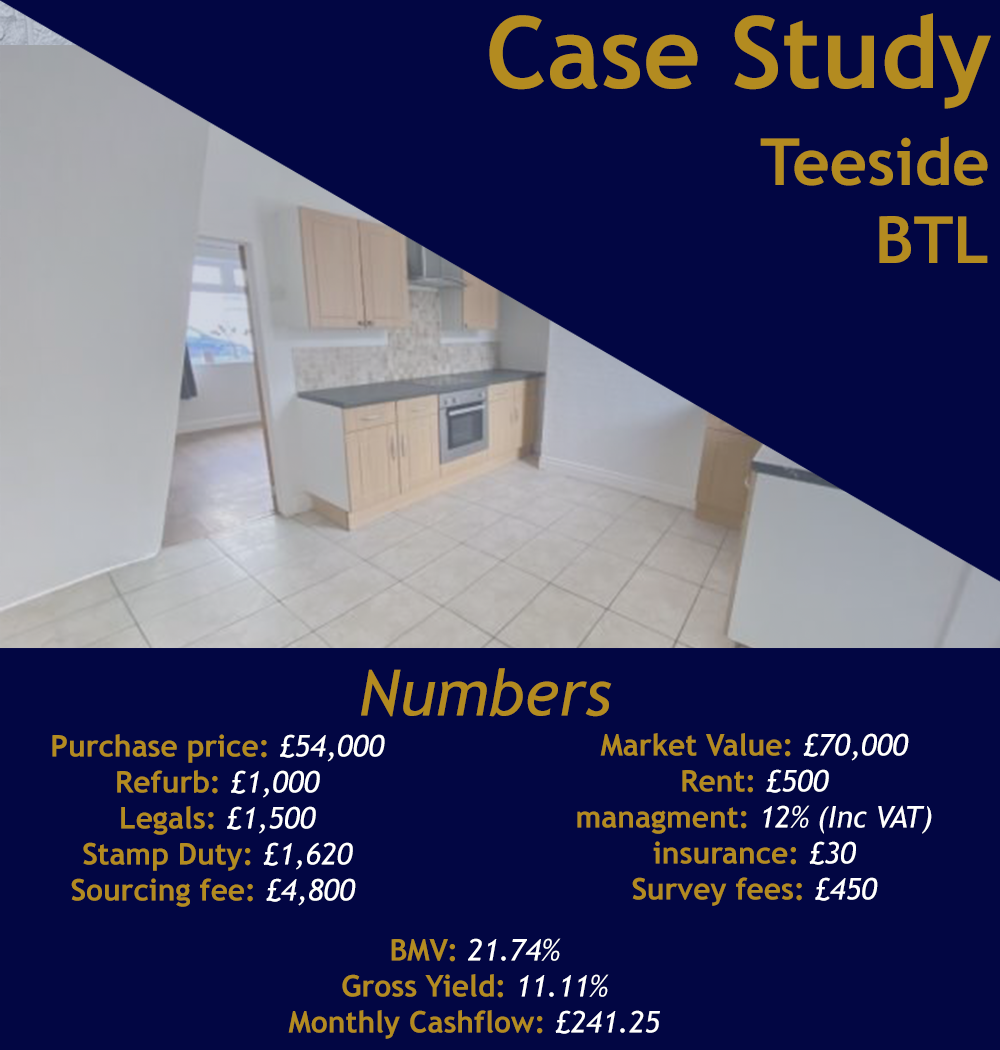

Our client purchased this Property for £54,000, it had tenants in situ paying £500pcm, which means it was achieving 11.11% Gross yield cashflowing over £250pcm on a 6% mortgage!

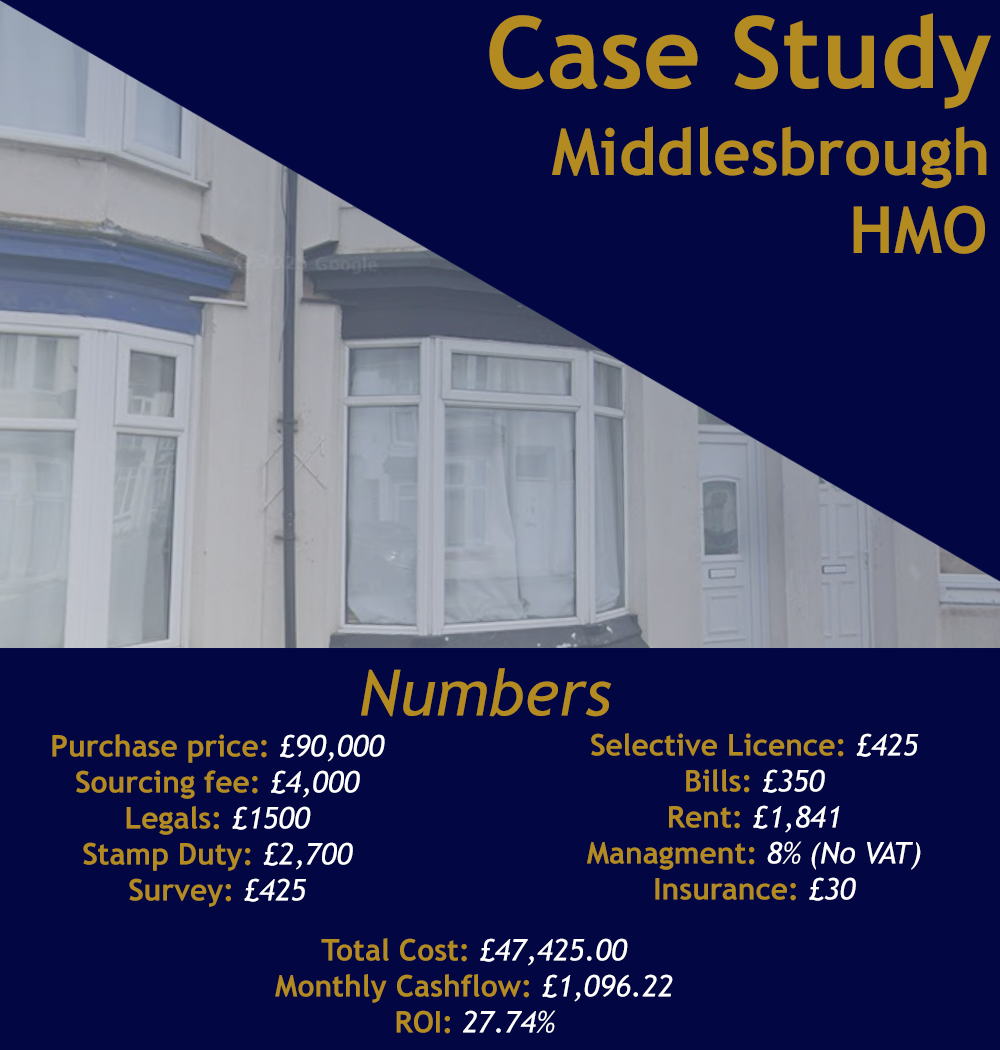

Our client purchased this Property for £90,000, it had tenants in situ paying £1841pcm, which means it was achieving 24.5% Gross yield cashfowing over £1000pcm on a 6% mortgage!

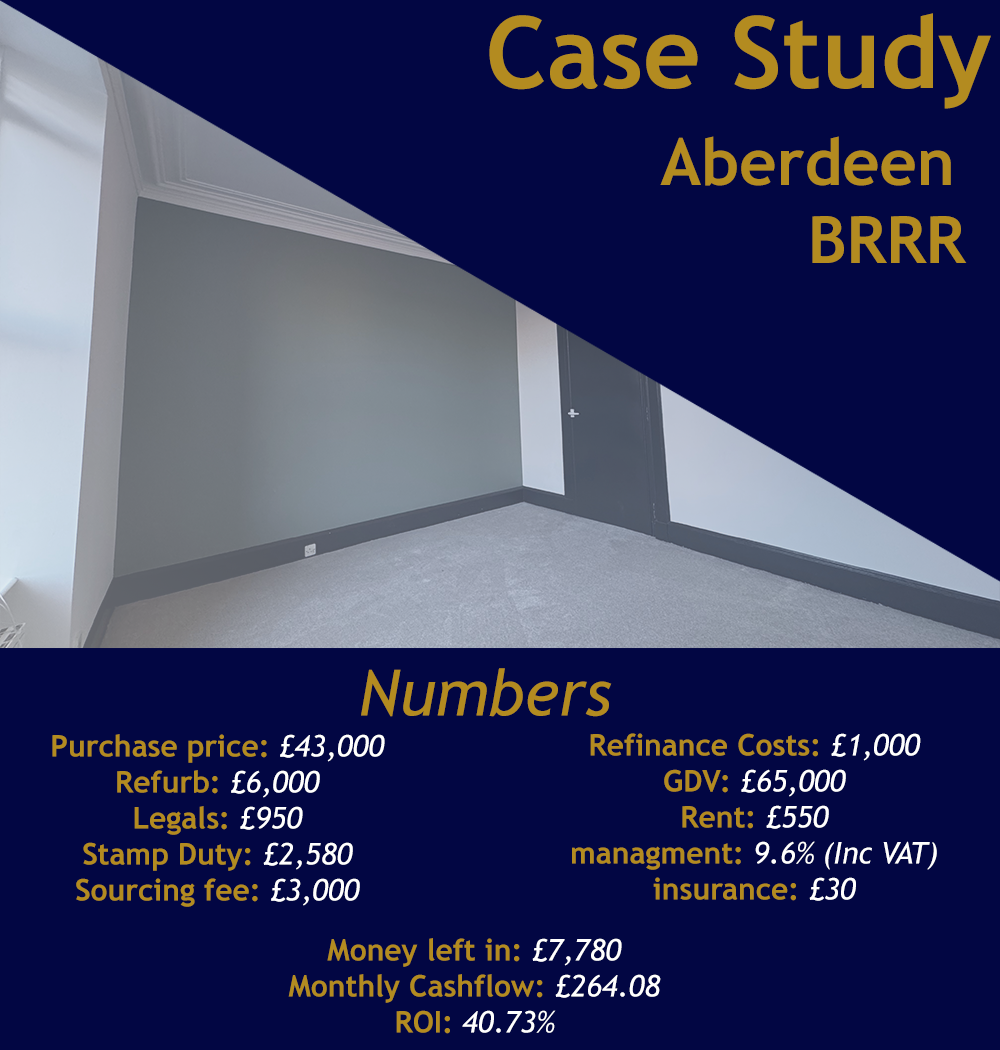

We secured this property at £43,000, after at £6k refurb a tenant moved in paying £550pcm

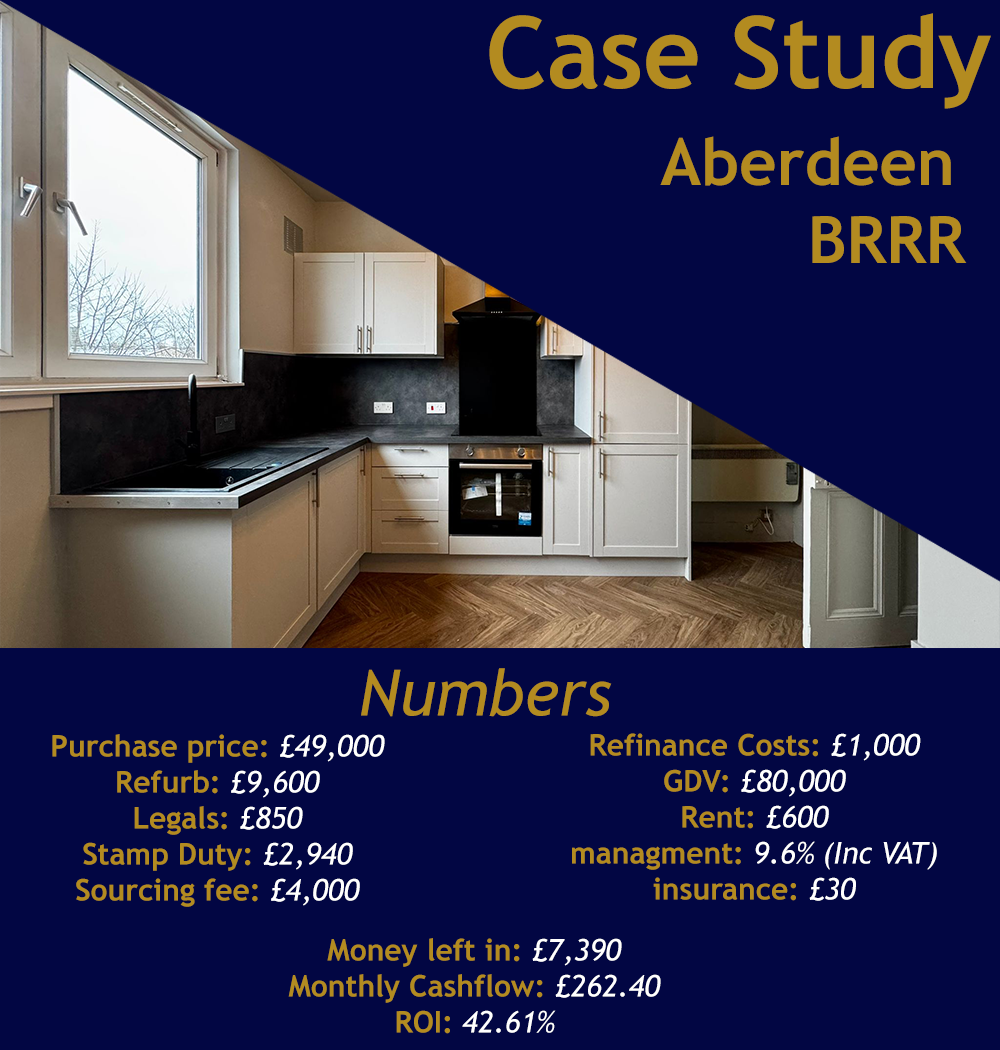

We secured this property at £49,000, after at £9.6k refurb a tenant moved in paying £600pcm, it was refinanced for £80,000 within 6 months of our client purchasing the property

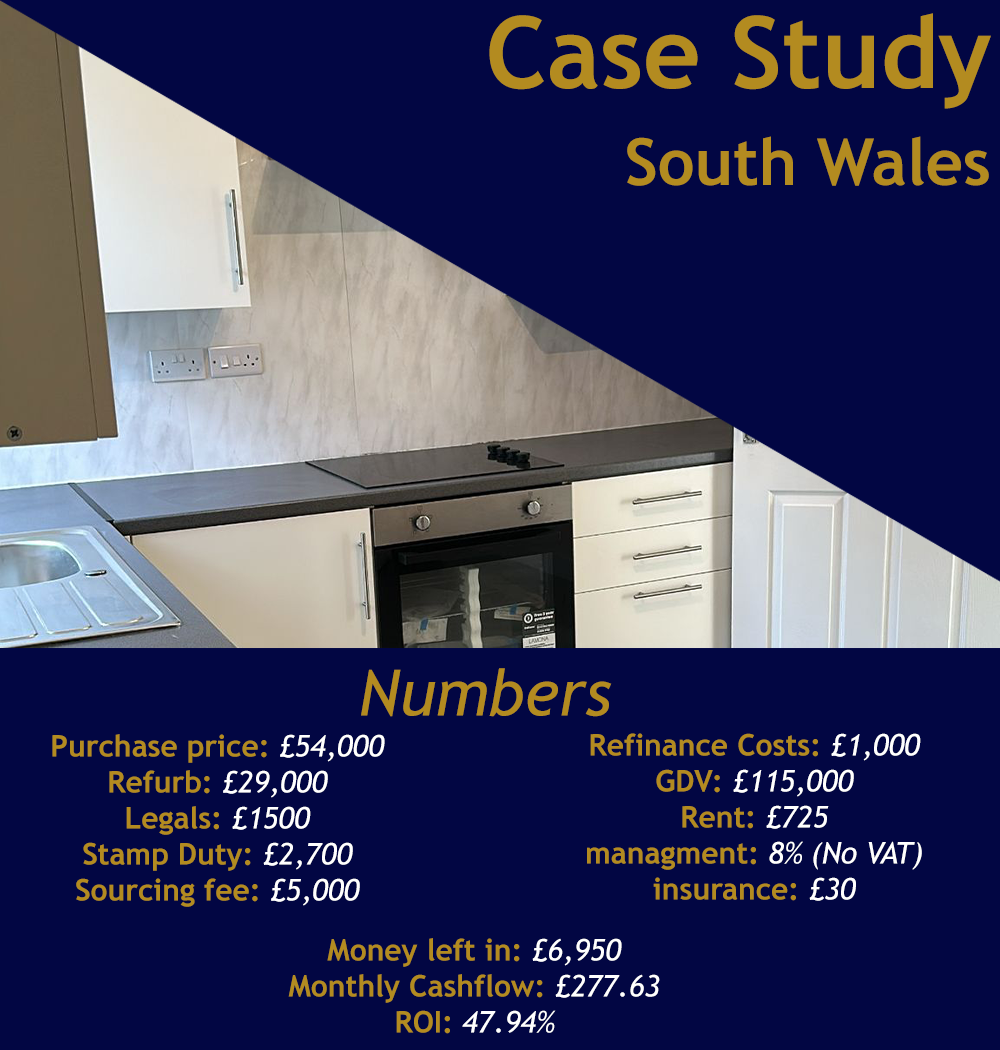

We secured this property for £54,000, after a £29k refurb (including some variations after a roof leak from a storm needing a repair), was refinanced at £120k (£10k higher than expected!), a tenant has now moved in paying £725pcm

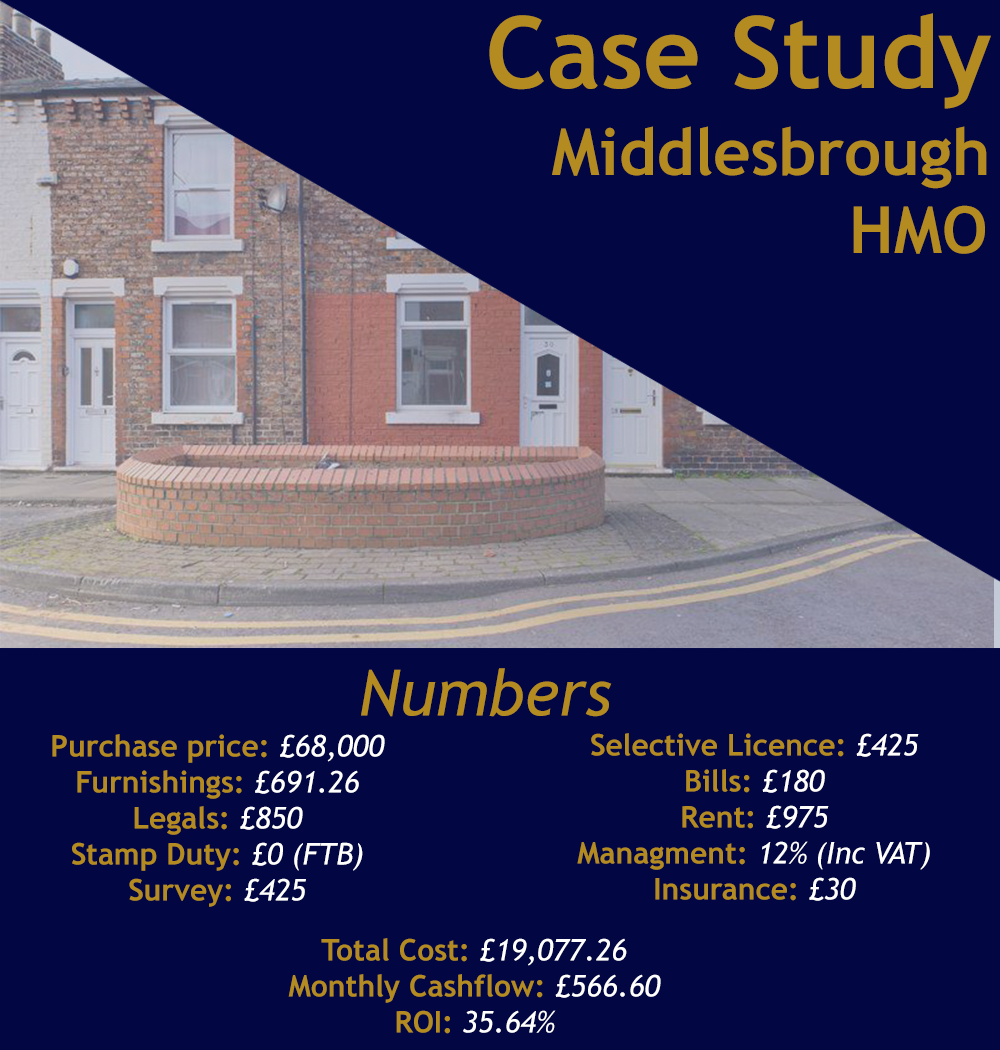

Located a stone's throw from the university, our client is paying £72 a month on mortgage repayments, the tenants are paying £975pcm, bringing our client a nice monthly profit of just over £600pcm

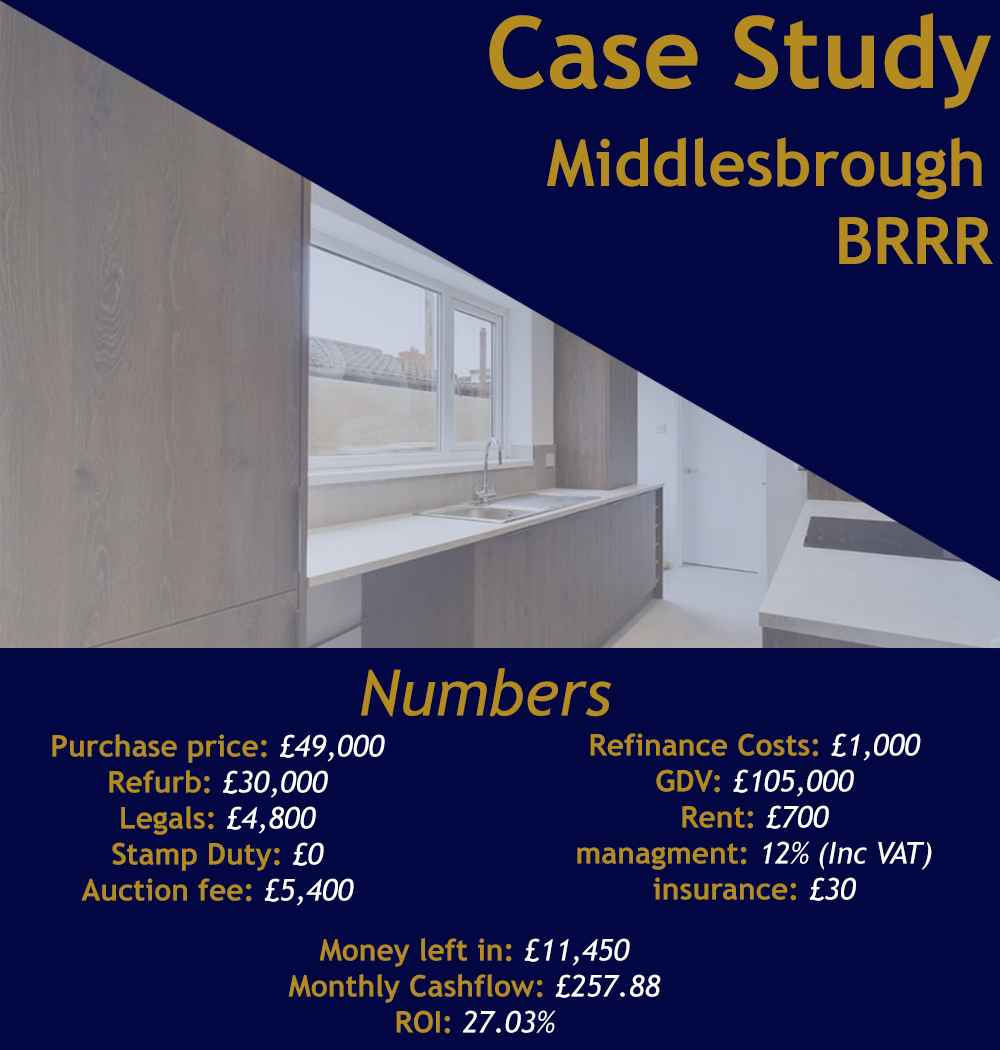

We secured this property at £49,000, after a £26,000 refurb, the property was revalued at £105,000, this then got a tenant in paying 700pcm

We use cookies to ensure the best experience on our website. By continuing to use our website, you agree to our use of cookies.

Your choice will be saved in your browser. Learn more in our Privacy Policy.